Emily, a millennial entrepreneur is facing common problems in the finance world: she needs quick and correct answers from her bank. She wants to make sure all her business dealings are legal and above board. She is also concerned about keeping her business information safe and private. These challenges show a bigger issue: people today want financial advice that fits their unique needs, but traditional ways of getting this advice aren’t cutting it. Emily’s situation shows that modern financial customers toolswant more than just basic services. They’re looking for personalized advice and solutions that match their specific life and business situations. This is where AI for personalized financial advice can help.

The use of AI in financial services is a big leap forward in solving these issues. By analyzing a lot of data in smart ways, AI can give advice that’s tailored just for one person or business. This move goes beyond just using new tech for the sake of it. It means that services can be much more precise and useful, making sure everyone’s individual needs are met accurately and efficiently.

According to Accenture, around 84% of banking executives view AI for financial advice as key to their future success. In plain terms, the use of AI means entrepreneurs like Emily can make informed decisions quickly, reflecting how financial services have adapted to meet modern demands more effectively.

AI Agents in Financial Advisory

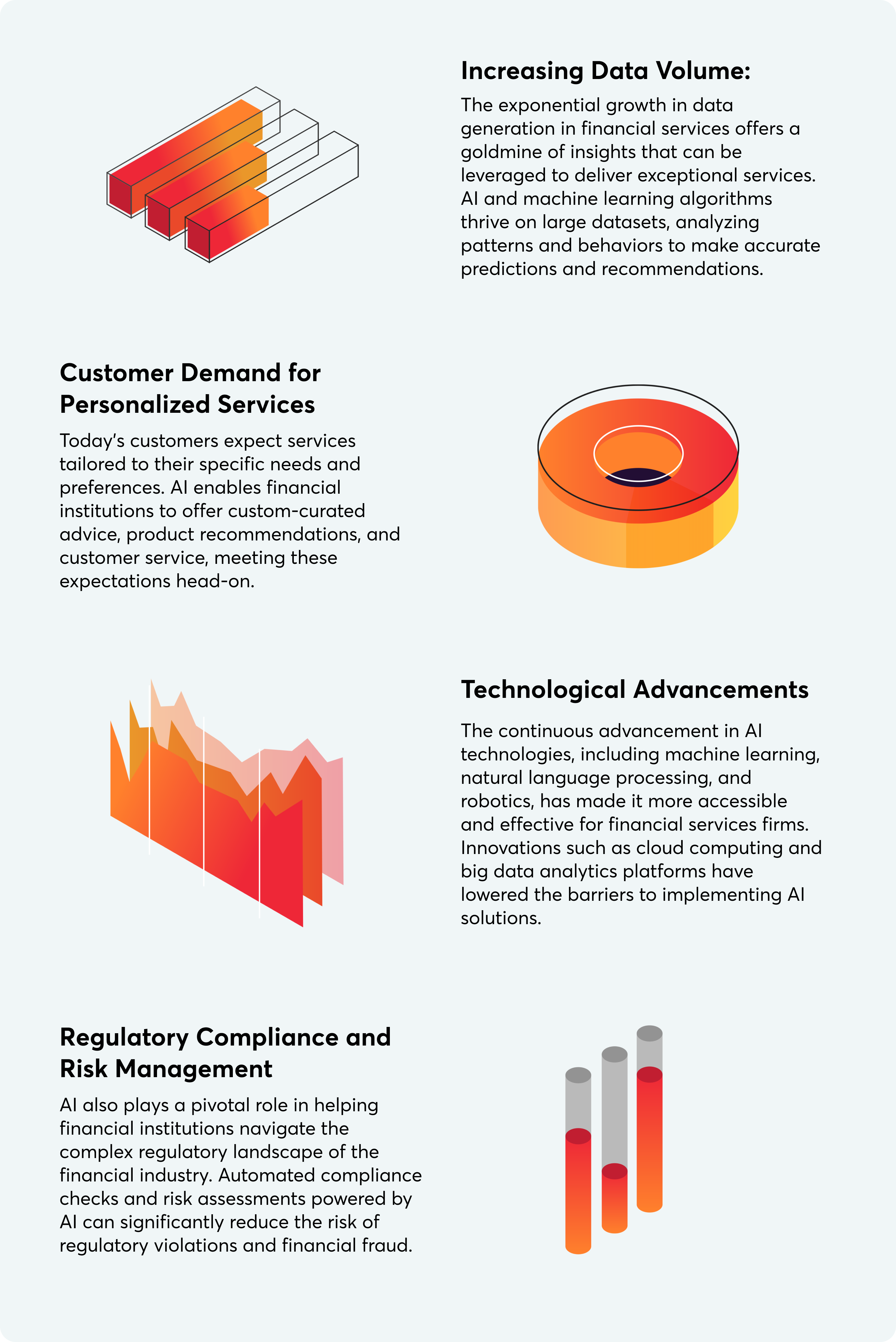

Artificial Intelligence in financial services is witnessing a remarkable surge, driven by technological advancements, and changing consumer expectations. This trend is evident in the BFSI sectors, where AI is playing a crucial role in reshaping business models and customer experiences.

Statista predicts that the financial sector’s investment in AI is projected to reach $45.19 billion by 2024. This reflects the industry’s recognition of AI’s potential to enhance operational efficiencies, improve customer service, and drive innovation.

Furthermore, the application of AI in fintech startups is growing rapidly, with these companies leveraging AI for everything from customer service chatbots to fraud detection and customized financial advice.

Key Drivers Behind AI Adoption

How AI Enables Personalized Financial Advice

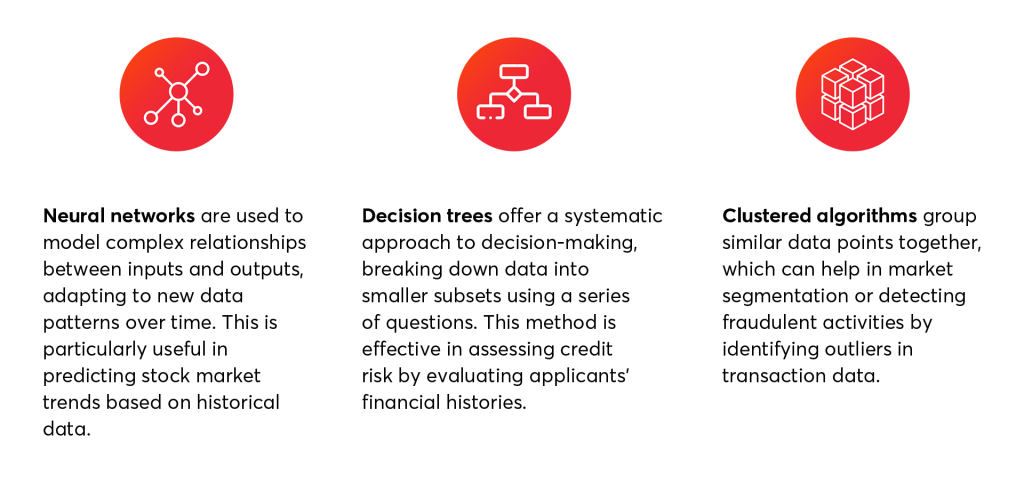

Here’s how AI is enabling this transformation through various technologies:

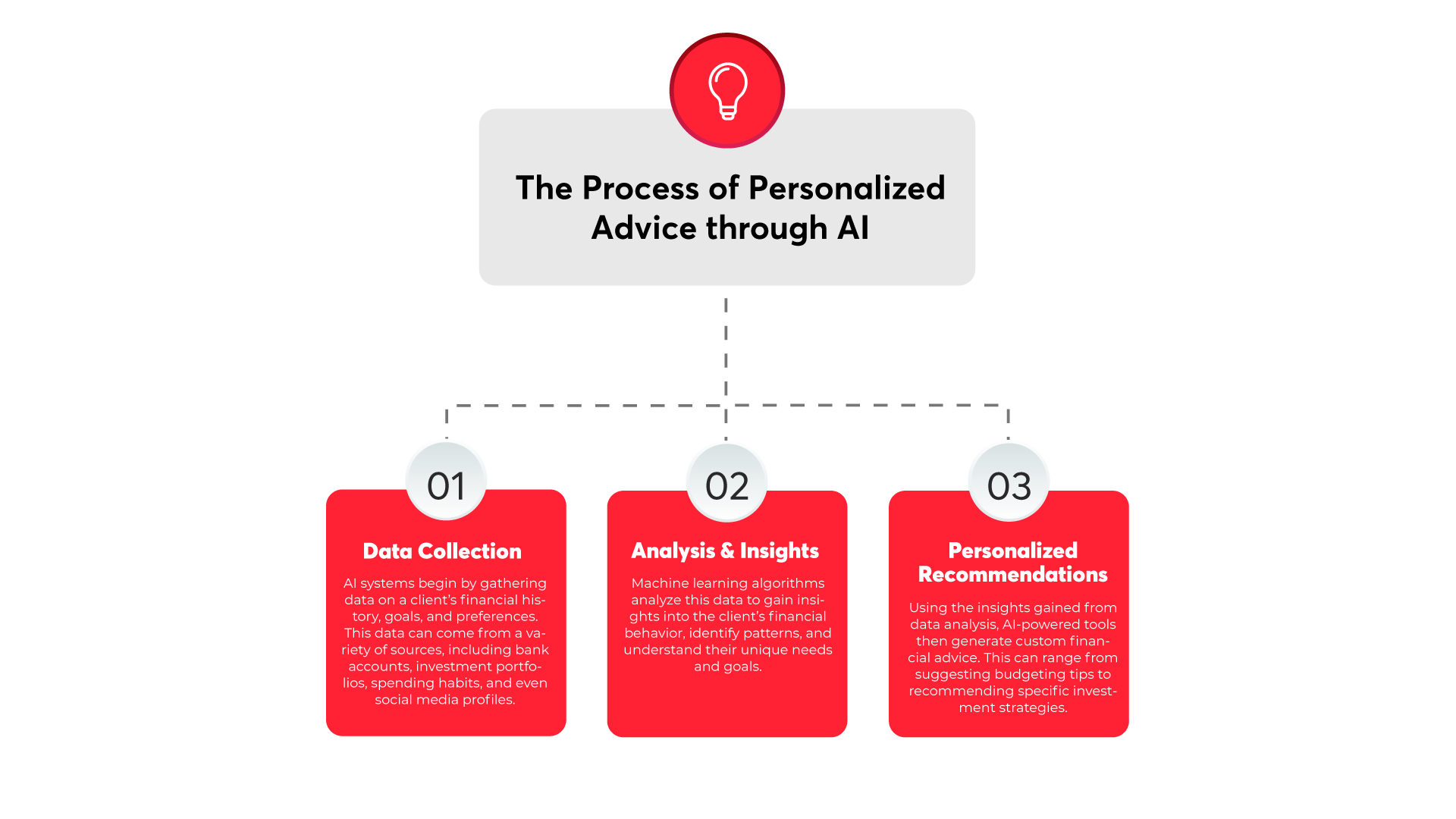

The Process of Using AI for Personalized Financial Advice

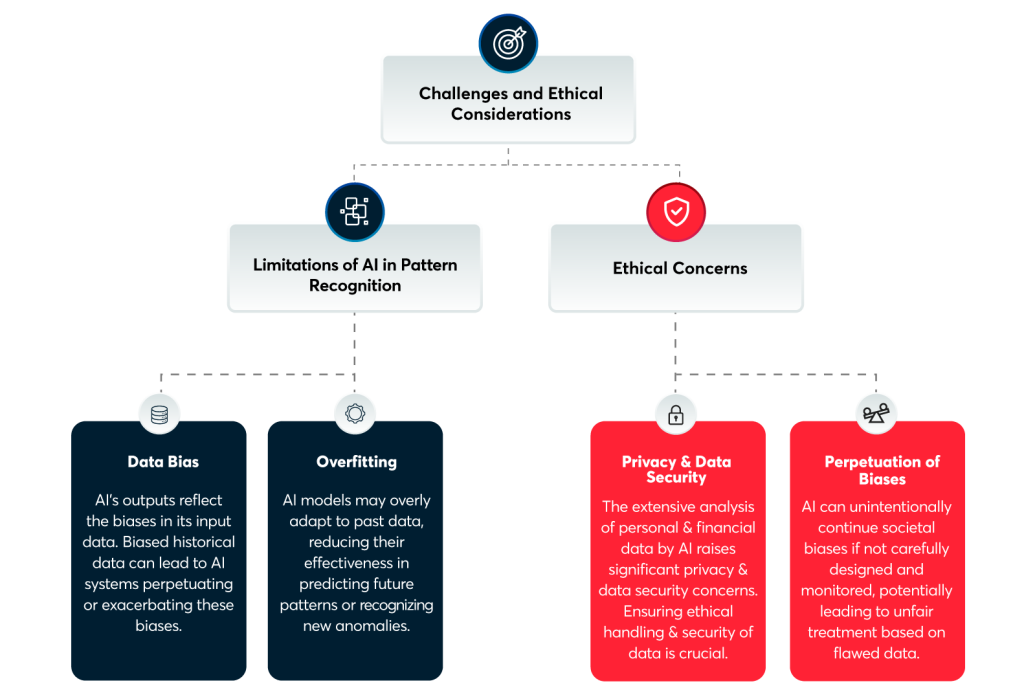

Challenges and Considerations in AI for Financial Services

The adoption of artificial intelligence in financial services has introduced significant advancements in BFSIs. Yet, this digital shift brings its own challenges that financial institutions must adeptly manage to fully leverage AI responsibly and effectively. When it comes to using AI for personalized advice, some challenges to consider include the following:

Data Privacy and Security Concerns

One of the challenges in deploying AI within financial services is ensuring the privacy and security of customer data. AI systems require access to vast amounts of personal and financial data to function effectively, raising significant concerns about data breaches and unauthorized access. Financial institutions must implement robust encryption and security protocols to protect sensitive information. This involves not only safeguarding the data but also ensuring transparency with customers about how their data is used and obtaining their consent.

Importance of Regulatory Compliance

AI’s role in financial advice also brings into focus the need for regulatory compliance. Financial markets are among the most heavily regulated sectors, and AI applications must comply with a myriad of laws and regulations designed to protect consumers and ensure market stability. This includes regulations around financial advice, data protection (such as GDPR), and anti-money laundering (AML) standards. Navigating this regulatory landscape requires a careful and informed approach to ensure that AI solutions are not only effective but also fully compliant with legal standards.

Addressing Biases in AI Algorithms

Another critical consideration is the potential for biases in AI algorithms, which can lead to unfair or biased financial advice. AI systems learn from historical data, and if this data contains biases, the AI’s decisions and recommendations can inadvertently perpetuate these biases. This scenario poses a significant risk of unfair treatment of certain customer segments. This can lead to reputational damage and legal challenges for financial institutions. Addressing this issue requires ongoing efforts to identify and mitigate biases in AI models, ensuring that financial advice is unbiased.

The Impact of AI on Customer Experience (CX) in Financial Services

The integration of Artificial Intelligence (AI) in financial services has significantly improved customer experience by offering customized and secure interactions. With the adoption of AI, financial institutions can address common pain points with a tangible solution such as:

Leading Companies and Banks Leveraging AI for Personalized Financial Advice

Several top financial institutions have successfully leveraged AI to enhance customer experience and operational efficiency:

Betterment

A robo-advisor platform, Betterment uses AI to provide investment advice based on individual risk tolerance, financial goals, and timelines. Betterment’s algorithms continuously monitor and rebalance portfolios to align with users’ objectives; making investing more accessible.

JP Morgan Chase

JPMorgan Chase employs machine learning algorithms to analyze transaction data, offering individualized banking advice and product recommendations to its customers. This approach helps customers make informed decisions and improves their financial health.

Wells Fargo

The American multinational financial services company has developed an AI-driven predictive banking feature within its mobile app. It analyzes customers’ financial transactions to provide insights, such as highlighting higher spending in a category or upcoming bill payments. Thus, aiding in better financial management.

Personal Capital

The online financial advisor and personal wealth management company. It offers AI tools to provide a comprehensive view of a user’s finances. It analyzes accounts to offer advice on budgeting, investing, and retirement planning. Their dashboard integrates data from various sources, providing users with tailored insights to optimize their financial decisions.

HSBC

HSBC has partnered with Personetics, a leading AI firm, to utilize predictive analytics for offering financial insights to customers. It helps them manage their finances better based on their transaction history and behavior.

The Path Forward with AI for Personalized Financial Advice

This exploration of AI’s role in the financial industry highlights the importance of understanding and addressing customer pain points through technology. As the industry seeks to address and surpass customer expectations through technology, VentureDive stands out as a leading Data and AI company, instrumental in driving growth and innovation. With a keen focus on balancing personalization with privacy, and streamlining processes while maintaining security, VentureDive’s expertise in tailoring AI and machine learning solutions offers financial institutions a competitive edge.